september Marks a Crucial time for Gold Trading in Q3

September Marks a Crucial Time for Gold Trading in Q3

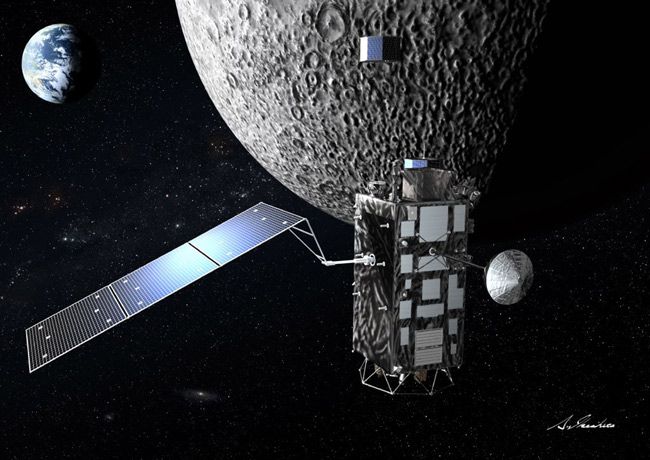

September marks a critical time for gold trading as it is the final month of the third quarter, a period when major financial institutions and investment funds typically lock in profits and liquidate assets on the market. This creates significant price volatility for gold, presenting both opportunities and challenges for individual investors. This year, the target price range of $2,564 to $2,592 per ounce is predicted by many experts to be the maximum profit margin that financial institutions and investment funds are aiming for.

The profit-taking activities of large financial institutions in September often exert selling pressure on the market, causing gold prices to experience substantial fluctuations. However, this is also an opportunity for agile investors who know how to take advantage of the timing to buy when prices dip and sell when they rise again, maximizing profits. Factors such as monetary policies from central banks, USD exchange rate fluctuations, and global geopolitical conditions will also significantly impact gold price movements during this period.

Keep a close watch on the gold market in September to seize the best investment opportunities while mastering effective trading strategies and risk management in a highly volatile market environment

2 tháng trước

36

2 tháng trước

36

English (United States) ·

English (United States) ·  Vietnamese (Vietnam) ·

Vietnamese (Vietnam) ·